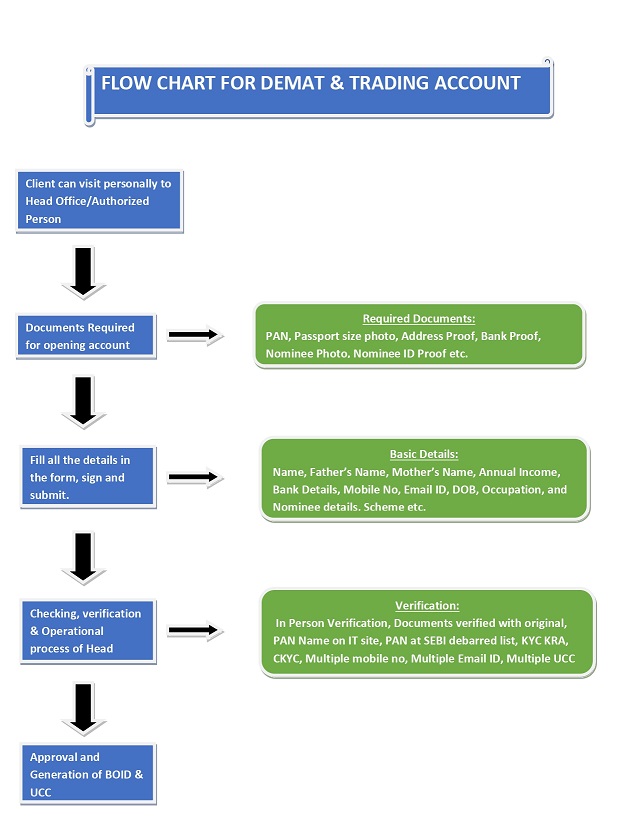

The below mentioned process is for opening of new Demat + Trading account

PART - A: Front End

(1) Client can visit personally at our Head Office/Authorized Person for opening of account along with

necessary details, documents in original and photo copies.

(2) Client will fill up all the necessary details in form and will sign account opening form, KYC form and will

submit the same to Head Office/Authorized Person along with photo copies of below listed documents:

- Self-attested copy of PAN Card

- Passport size photo

- Self-attested copy of Address Proof

- Bank Proof

- Nominee details

- Nominee Photo

- Self-attested copy of Nominee’s ID Proof

- DDPI POA (For Pay-In) if any

PART - B: Checking

(3) Head Office/Authorized Person will verify the details mentioned in the form with photo copies of the documents

and with original documents and after verification Head Office/Authorized Person will affix “In Person Verification” & “Verified

with Original” stamp on form & documents.

(4) Head office will follow below check points.

PAN Name on IT site, Multiple UCC with same PAN, PAN with SEBI debarred list, KYC KRA, CKYC, Multiple Mobile No and

Multiple Email ID etc

PART - C: Operational

(5) After checking part is completed and found to be in order, entry maker will enter basic details of client in Back

office software from the form and will upload required documents. Post completion of entry maker part, entry checker

will find the form in Back office and will verify all the details and documents entered/uploaded by entry maker with

form and documents.

(6) Post completion of maker-checker parts, records will be uploaded at Depository and Exchanges for generation of

Demat Account (BOID) and Trading Account (UCC).